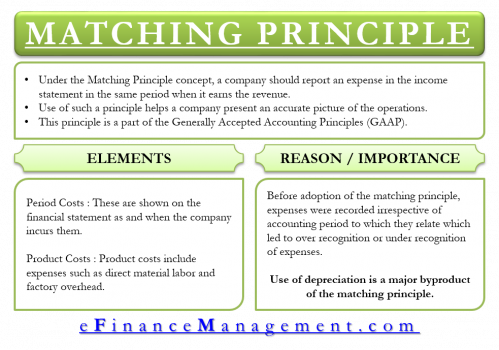

The matching concept or revenue recognition concept is not used in the cash accounting method. This is the system used by individuals when budgeting household expenses and by some small businesses. In the cash accounting method, revenues and expenses are recognized when cash is transferred. Accrual accounting entries require the use of accounts payable and accounts receivable journals, as well as a few others for deferred revenue and expenses, depreciation, etc. This is done by following the matching principle. Expenses are similarly recognized when they are incurred. This usually will happen before money changes hands, for example when a service is delivered to a customer with the reasonable expectation that money will be paid in the future. In the accrual accounting method, revenue is accounted for when it is earned. Cash Accounting Accrual Accounting Method This provides auditors with a so-called apples-to-apples comparison of a company’s financial picture that is more transparent across industries.Īccrual Accounting vs. A company should recognize revenue in the period in which it was earned, and not necessarily when the cash was received.įor a subscription SaaS provider, this can mean breaking up the money received from an annual subscription into the monthly periods as the services are provided. Revenue recognition concept: This principle refers to the period and manner in which a company realizes its income. This means that expenses should be matched to the revenue they generate and therefore be shifted into the period in which the revenue was earned instead of being recorded in the period they were paid for. Matching concept: This principle stipulates that accountants should record all revenue and expenses in the same reporting period. GAAP (Generally Accepted Accounting Principles) and should be used by any entity following the accrual accounting system. The matching principle aims to minimize any mismatch in timing between when an organization incurs costs and when it realizes any associated revenue.The matching principle and the revenue recognition principle are the two main guiding theories underlying accrual accounting.This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession.Īccounting Concepts and Conventions | Basic Accounting Concepts and Financial Statements | Cash Accounting | Accrual Accounting | Basic Accounting Terms | Revenue Recognition Principle | Matching Principle | Example Income Statement. If you are required to produce such figures for internal use then you need to adhere to its internal definitions. The accounting standards and regulations of your operating country will dictate how such items are represented in your organization's published accounts. The way in which an organization can interpret an item of high-value capital equipment designed for longevity is open to interpretation, and a new model or changes in technology can drastically alter its life span. It is difficult to be exact in such cases because they are influenced by numerous factors, and many, such as changes within the economic climate, are outside of an organization's control. This is especially true in the case of provisions for bad debt and depreciation.

The more complicated they are, the more difficulty your organization will have in 'matching' the date costs occur with the date revenue or income is received. The degree to which this can be achieved will be influenced by how complex your operations are. This still has to be attained whilst adhering to the accounting standards of recording costs as they occur and revenue when it is earned. This principle achieves this by minimizing, wherever possible, the mismatch in timing between when your organization incurs costs and when it realizes its revenue. This is because it enables your financial accounts to show a better evaluation of actual profitability and performance.

#MATCHING PRINCIPLE. HOW TO#

Your organization may prefer to use the matching principle when deciding how to record its financial performance.

0 kommentar(er)

0 kommentar(er)